Stacks (STX) is more than just another cryptocurrency. It’s a paradigm shift for Bitcoin, aiming to transform the world’s first and most secure blockchain into a platform for smart contracts and decentralized applications (dApps). As a financial expert, let’s dissect the intricacies of STX, analyzing its potential and the key considerations for investors.

The Smart Contract Conundrum and Bitcoin’s Limitations

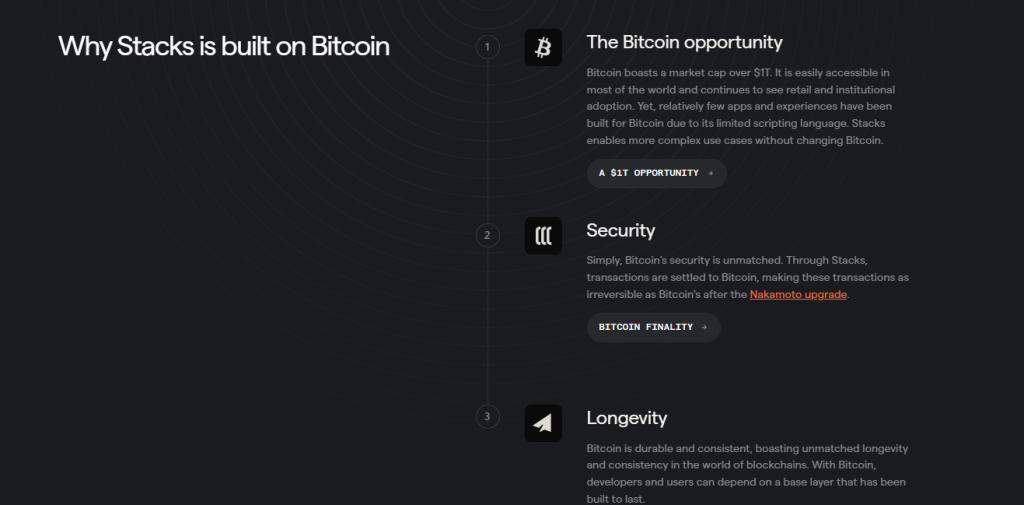

Smart contracts have revolutionized finance, enabling self-executing agreements without intermediaries. However, Bitcoin, the undisputed king of crypto, struggles to support them effectively. Its core design prioritizes security and decentralization, leading to limitations in:

- Scalability: The sheer volume of transactions needed to execute complex smart contracts would strain Bitcoin’s network.

- Flexibility: Bitcoin’s scripting language (Script) is relatively primitive compared to languages designed specifically for smart contracts. This hinders the complexity and functionality of dApps on Bitcoin.

Stacks: The Ingenious Layer-2 Solution

Stacks tackles these limitations by introducing a layer-2 solution. Imagine Bitcoin as the secure foundation of a house, and Stacks as a versatile second floor that allows for innovation. Here’s how it works:

- The Stacks Blockchain: A separate blockchain built on top of Bitcoin. This provides the necessary scalability and flexibility for smart contracts and dApps to flourish.

- Proof of Transfer (PoX): The Stacks consensus mechanism leverages Bitcoin’s security. Miners on the Stacks blockchain “burn” Bitcoin (send it to an unspendable address) to earn STX rewards. This creates a strong cryptographic link between the two blockchains, inheriting Bitcoin’s security without compromising scalability on the Stacks chain.

The STX Ecosystem: Fueling Innovation

STX, the native token of the Stacks blockchain, plays a critical role in this ecosystem:

- Securing the Network: “Stacking” allows STX holders to lock up their tokens and participate in the consensus mechanism. In return, they earn Bitcoin rewards, incentivizing network security.

- Smart Contract Execution: STX is used to pay for transaction fees associated with running smart contracts on the Stacks blockchain.

- Governance: STX holders have voting rights on the future development of the Stacks network. This fosters a decentralized and community-driven approach.

Unleashing Potential: Use Cases for Stacks (STX)

STX isn’t just about securing the Stacks blockchain or fueling smart contract execution. It unlocks a diverse range of use cases that could revolutionize various sectors within the crypto space. Let’s delve into some of the most promising applications:

1. Decentralized Finance (DeFi) on Bitcoin:

- STX as Collateral: DeFi protocols built on Stacks could allow users to leverage their STX holdings as collateral for loans and other financial instruments. This injects much-needed liquidity into the Stacks ecosystem.

- Bitcoin-Backed Stablecoins: Imagine a stablecoin pegged to the value of Bitcoin, but issued and managed on a decentralized platform like Stacks. This could provide a more secure and transparent alternative to existing centralized stablecoins.

- Advanced DeFi Products: Stacks’ smart contract capabilities open doors for complex DeFi products like decentralized exchanges, margin trading, and automated yield farming, all leveraging the security of Bitcoin.

2. Non-Fungible Tokens (NFTs) with Bitcoin Security:

- Securing Digital Ownership: NFT marketplaces built on Stacks could offer creators and collectors the unparalleled security of Bitcoin for their digital assets. This is particularly valuable for high-value NFTs representing artwork or collectibles.

- NFT Provenance and Tracking: Stacks’ smart contracts can be used to track the ownership history and authenticity of NFTs, reducing the risk of fraud and counterfeiting in the NFT space.

- Bitcoin-Backed Fractional Ownership: Imagine co-owning a rare digital asset represented as an NFT on Stacks. This could democratize access to high-value collectibles by allowing fractional ownership, all secured by the Bitcoin blockchain.

3. Secure and Decentralized Social Media:

- Data Ownership and Privacy: Social media applications built on Stacks could empower users with true ownership of their data. This data could be stored on the Bitcoin blockchain, leveraging its security and immutability.

- Content Monetization: Stacks’ smart contracts could enable innovative ways for creators to monetize their content directly, without relying on centralized platforms that take a significant cut.

- Censorship-Resistant Communication: By leveraging Bitcoin’s decentralized nature, Stacks-based social media platforms could offer greater resistance to censorship, fostering a more open and democratic online environment.

4. Decentralized Identity Management:

- Self-Sovereign Identity (SSI): Stacks can be used to create and manage digital identities that users control entirely. This eliminates the need for relying on centralized authorities for identity verification.

- Secure Logins and Data Sharing: Imagine using your STX identity to securely log in to various dApps or share data selectively, all without compromising privacy.

- Building Trust in the Decentralized Web: SSI powered by Stacks could become a cornerstone of trust and reputation management in the Web3 space.

Current Landscape and Future Outlook (as of March 3, 2024):

- Market Performance: STX is currently trading around $2.93, with a market capitalization exceeding $4 billion. While it recently hit an all-time high, the price remains volatile, reflecting the project’s early stage.

- Adoption and Development: The Stacks ecosystem is nascent but rapidly growing. Several dApps are already live, spanning DeFi protocols, NFT marketplaces, and even social media applications leveraging Bitcoin’s security for user data.

- Potential Challenges: Mainstream adoption of smart contracts on Bitcoin is crucial for STX’s success. Additionally, competition from established smart contract platforms like Ethereum and regulatory uncertainties pose significant challenges.

Investment Considerations: A Calculated Move

- High-Risk, High-Reward: STX offers the potential for substantial returns if the Stacks ecosystem flourishes and becomes the go-to platform for smart contracts on Bitcoin. However, the project’s nascent stage and the inherent volatility of the cryptocurrency market present substantial risks.

- Strategic Investment: For investors bullish on Bitcoin’s long-term value proposition, STX could be a strategic way to gain exposure to smart contracts within the Bitcoin ecosystem. This could potentially offer the best of both worlds: Bitcoin’s security and the functionality of smart contracts.

- Beyond Price: Don’t just focus on the price of STX. Evaluate the development progress of the Stacks ecosystem, the functionality and traction of dApps being built, and the overall team behind the project.

Conclusion

Stacks (STX) is a bold experiment with the potential to unlock a new era for Bitcoin. While challenges remain, the potential benefits for both Bitcoin and the broader blockchain space are undeniable. For investors seeking exposure to this innovative project, a thorough due diligence process and a risk-tolerant investment strategy are essential. Remember, the future of STX is intrinsically linked to the success of the Stacks ecosystem and its ability to navigate the ever-evolving landscape of blockchain technology.

Here are some resources for more information on Stacks (STX):

Official Resources:

- Stacks Website: https://www.stacks.co/

- Stacks Whitepaper: https://gaia.blockstack.org/hub/1AxyPunHHAHiEffXWESKfbvmBpGQv138Fp/stacks.pdf (technical details)

- Stacks Blog: https://www.stacks.co/ (updates and news)

- Stacks Developer Resources: https://docs.stacks.co/