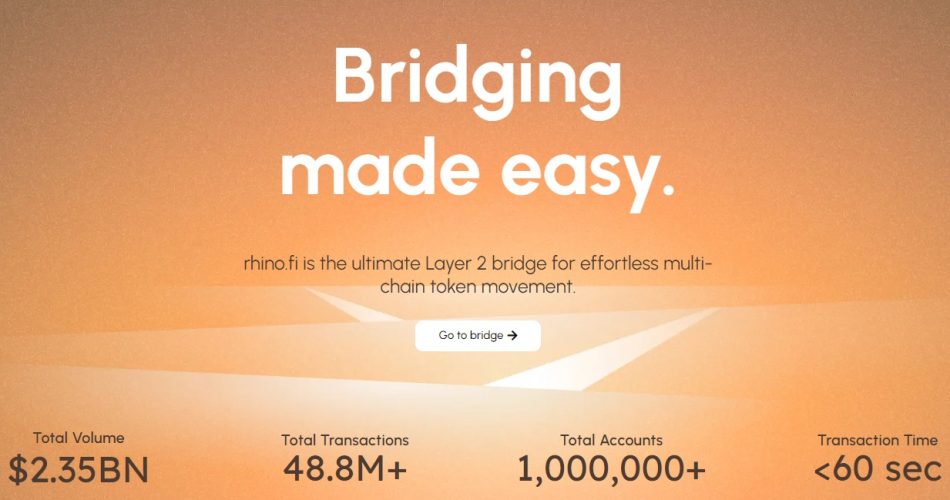

In the dynamic world of Decentralized Finance (DeFi), navigating the complexities of isolated blockchains can be a significant obstacle. rhino.fi emerges as a powerful bridge, aiming to dismantle these barriers and empower users with a blazing-fast, secure, and user-friendly platform for cross-chain transactions. This in-depth review delves into the intricacies of rhino.fi, explores its potential benefits and drawbacks, and equips you with the knowledge to determine if it aligns with your DeFi aspirations.

Understanding rhino.fi: A Multi-Chain Powerhouse

rhino.fi operates as a multi-chain platform built upon the innovative StarkEx technology. This translates to lightning-fast transactions with significantly lower fees compared to the typical blockchain experience. Imagine sending crypto assets between different blockchains in a matter of seconds, all while incurring minimal costs – that’s the power of rhino.fi. The platform positions itself as a comprehensive hub for various DeFi activities, including:

- Effortless Bridging: Transfer your crypto holdings between various blockchains with ease. rhino.fi bridges the gap between EVM-compatible chains (e.g., Ethereum, Polygon) and even non-EVM chains (e.g., Solana, Binance Smart Chain), fostering a truly unified DeFi experience. No more cumbersome processes or reliance on third-party bridges – rhino.fi streamlines the process.

- Seamless Swapping: Exchange cryptocurrencies directly within the rhino.fi interface, leveraging efficient liquidity pools. This eliminates the need to navigate complex decentralized exchanges (DEXs) and ensures you get the most competitive rates for your swaps.

- Future Trading Potential: While still under development, rhino.fi has plans to incorporate trading functionalities, potentially allowing users to engage in margin trading, derivatives, and other advanced strategies. This could make rhino.fi a one-stop shop for all your DeFi trading needs.

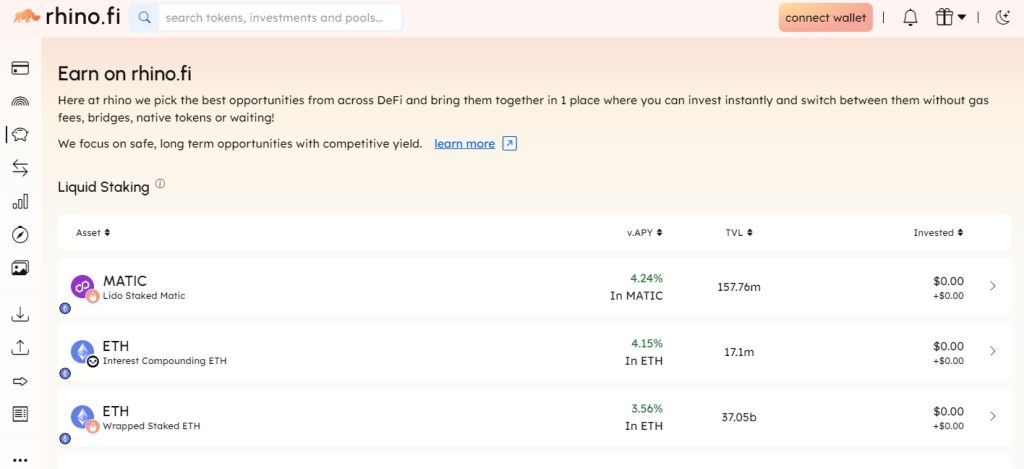

- Investment Opportunities at Your Fingertips: Explore a curated selection of potential investment opportunities within the DeFi ecosystem, directly accessible through rhino.fi. This could include opportunities to earn interest on your crypto holdings through lending protocols or participate in yield farms. (Availability of specific investment options may vary depending on market conditions and platform development)

- Earning on Your Crypto (Future Functionality): Keep an eye out for future developments, as rhino.fi plans to introduce functionalities that allow users to earn passive income on their crypto holdings. This could potentially involve staking your crypto or participating in liquidity pools.

Key Features of rhino.fi:

- Blazing-Fast Transactions: Experience near-instantaneous transactions compared to traditional blockchains. StarkEx technology empowers rhino.fi to process transactions significantly faster, allowing you to move your crypto assets swiftly and efficiently.

- Unwavering Security: Benefit from the robust security measures of StarkEx. Your crypto holdings remain safe and secure throughout the entire process, providing you with peace of mind.

- Self-Custody in Focus: Maintain complete control over your crypto assets at all times. rhino.fi prioritizes self-custody, ensuring you are the sole owner and have complete authority over your crypto holdings.

- Interoperability Redefined: Connect seamlessly to various blockchains, fostering a more unified DeFi experience. rhino.fi breaks down the barriers between different blockchains, allowing you to leverage the power of the entire DeFi ecosystem.

- Cost-Effective Transactions: Enjoy significantly lower transaction fees compared to base layer blockchains. StarkEx technology plays a crucial role here, enabling rhino.fi to offer a cost-effective solution for your cross-chain transactions.

User Reviews and Potential Considerations

While rhino.fi is a relatively new player in the ever-evolving DeFi landscape, early adopters have generally commended its speed, security, and user-friendly interface. However, it’s important to consider some potential drawbacks before diving in:

- Limited Functionality (as of March 2024): Some functionalities like advanced trading options and earning features are still under development. While the core functionalities like bridging and swapping are functional, the platform might lack the comprehensive suite of features offered by more established DeFi platforms.

- A Newcomer in the Arena: The platform’s relative novelty might raise concerns for some users regarding long-term stability and potential risks associated with a newer platform. Further research and due diligence are crucial before entrusting your crypto assets to any platform.

- Researching the DVF Token: The DVF token is associated with rhino.fi. Before making any investment decisions related to the DVF token, it’s essential to conduct thorough research on its tokenomics (distribution, utility).

rhino.fi vs. The Competition: A Cross-Chain Bridge Showdown (March 2024 Update)

In the ever-evolving landscape of cross-chain bridges, rhino.fi stands out with its focus on speed, security, and user-friendliness. But how does it stack up against established players? Here’s a comparison of rhino.fi with some of its key competitors:

| **Competitor | Key Features | Strengths | Weaknesses** |

|---|---|---|---|

| Hop Protocol | Utilizes a “bonded relay” system for trustless bridging. Supports a wide range of assets and blockchains. | Decentralized approach, good asset coverage. | Can be complex for beginners, potentially higher fees. |

| Multichain (formerly AnySwap) | User-friendly interface with a focus on ease of use. Supports various blockchains. | Simple to use, good token support. | Centralized operation raises security concerns, limited transparency. |

| Wormhole | High-throughput bridge utilizing the Solana blockchain. | Fast and scalable, supports Solana integration. | Centralized governance, potential Solana ecosystem dependence. |

| Synapse | Focused on security and utilizes a “liquidity bootstrapping mechanism” for faster bridging. | Strong security focus, innovative liquidity solution. | Limited asset support compared to some competitors. |

| rhino.fi | Leverages StarkEx technology for near-instantaneous transactions. Low fees, user-friendly interface, self-custody. | Speed, security, user experience, self-custody. | Newer platform, limited functionality compared to some established players (as of March 2024). |

Choosing the Right Bridge:

The ideal cross-chain bridge for you depends on your specific needs and priorities. Here’s a breakdown to help you decide:

- For Speed and Security: If prioritizing speed, security, and a user-friendly interface, then rhino.fi is a strong contender. Its reliance on StarkEx technology offers significant advantages in transaction speed and cost-effectiveness.

- For Decentralization: If a completely decentralized solution is paramount, Hop Protocol might be a better choice. However, it can be more complex for beginners.

- For Established Players: If you value a track record and a wider range of supported assets, established platforms like Multichain might be worth considering. Be mindful of the centralized aspects of such platforms.

- For Specific Blockchain Integration: If you primarily interact with the Solana ecosystem, Wormhole could be an option due to its Solana focus. However, its centralized governance structure might be a concern for some users.

A Step-by-Step Guide (Updated for March 2024)

rhino.fi streamlines the process of transferring crypto assets between different blockchains. Here’s a step-by-step guide to help you navigate bridging your assets on the platform:

Before You Begin:

- Ensure you have crypto holdings: Make sure you have the crypto assets you want to bridge readily available in the wallet you plan to connect to rhino.fi.

- Choose your destination chain: Decide on the blockchain you want to transfer your assets to. rhino.fi supports various EVM-compatible chains and is planning to integrate non-EVM chains in the future.

- Familiarity with gas fees: While rhino.fi boasts lower fees compared to traditional blockchains, it’s still recommended to have some crypto allocated for gas fees associated with the bridging process.

Step 1: Access rhino.fi

- Head over to the rhino.fi website using your preferred web browser. (https://rhino.fi/)

Step 2: Connect Your Wallet

- Click the “Connect Wallet” button on the rhino.fi homepage.

- A pop-up window will appear, displaying a list of compatible wallets you can connect with. Choose the wallet where you hold the crypto assets you want to bridge. (Popular options include MetaMask, WalletConnect, etc.)

- Follow the on-screen instructions provided by your chosen wallet to establish the connection with rhino.fi. This might involve approving the connection request and granting rhino.fi access to your wallet’s functionalities.

Step 3: Navigate to the Bridge

- Once your wallet is connected, locate the “Bridge” section on the rhino.fi interface. This might be a dedicated button or a tab within the platform.

Step 4: Select Assets and Chains

- In the bridge section, choose the crypto asset you want to transfer. A dropdown menu will likely display the supported assets.

- Select the originating chain (the blockchain where your assets currently reside) from the designated dropdown menu.

- Choose the destination chain (the blockchain you want to transfer your assets to) from another dropdown menu.

Step 5: Review and Confirm

- The bridge interface will display an estimated amount of the crypto asset you will receive after accounting for bridge fees.

- Carefully review the details, including the amount you are bridging, the originating and destination chains, and the estimated amount you will receive.

- Once you’ve double-checked everything, click the “Confirm” button to initiate the bridging process.

Step 6: Transaction Approval

- A confirmation window will likely appear from your connected wallet, requesting your approval for the bridging transaction. This window might display the gas fees associated with the transaction.

- If the details are correct and you’re comfortable with the fees, proceed with confirming the transaction within your wallet.

Step 7: Monitor the Transaction

- The bridging process might take a few seconds to a few minutes depending on network congestion. You can monitor the transaction progress within your connected wallet or through an explorer for the destination chain.

Step 8: Accessing Bridged Assets

- Once the bridging transaction is successful, your transferred crypto assets should be reflected in your wallet on the destination chain. The specific location of your bridged assets within your wallet might vary depending on the wallet you’re using.

Here are some links for more information about rhino.fi and cross-chain bridges:

- rhino.fi Website: https://rhino.fi/

- CoinMarketCap (DVF Token): https://coinmarketcap.com/currencies/rhino/

- DappRadar (rhino.fi): https://dappradar.com/dapp/rhino-fi

- Hop Protocol: https://hop.exchange/

- Multichain (formerly AnySwap): https://multichain.xyz/

- Wormhole Bridge: https://portalbridge.com/

- Synapse Bridge: https://synapseprotocol.com/?fromChainId=1