Information is power. With countless protocols, complex mechanisms, and ever-shifting market dynamics, navigating this landscape can be daunting. That’s where DefiLlama emerges as a knight in shining armor, offering a treasure trove of data and insights to empower crypto enthusiasts and financial experts alike. But is it the right tool for you? Let’s delve deeper into the world of DefiLlama and unveil its potential.

Unveiling DefiLlama: Your DeFi Data Powerhouse

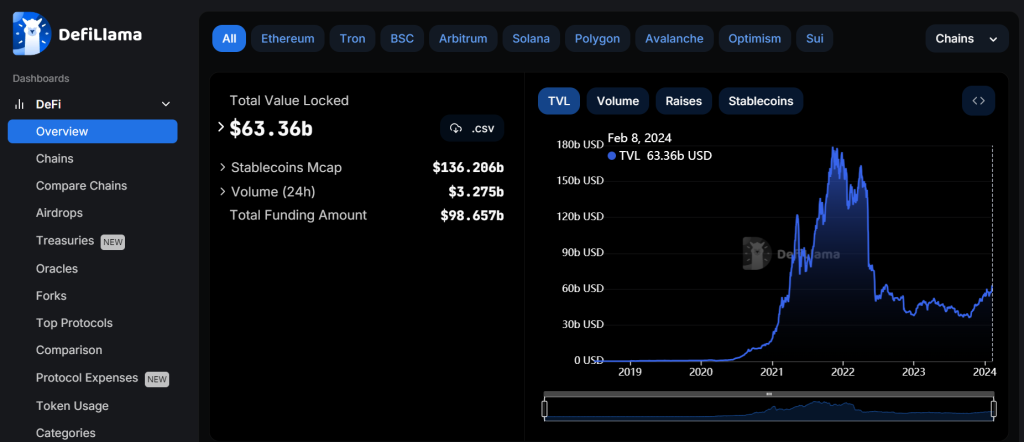

Founded in 2020, DefiLlama has carved a niche as a leading DeFi data aggregator and analytics platform. Its core strength lies in providing a real-time snapshot of the DeFi industry’s health through Total Value Locked (TVL) tracking across various protocols. But DefiLlama’s magic extends far beyond simple numbers. Here’s a glimpse into its diverse feature set:

- Protocol Rankings: Dive into curated lists of the top DeFi protocols, categorized by blockchain (e.g., Ethereum, Solana, Avalanche) and niche (e.g., Lending, DEXes, Derivatives). Gain instant insights into the most popular and active sectors within the DeFi ecosystem.

- Yield Farming Opportunities: Don’t miss out on lucrative returns! DefiLlama shines a light on high-yielding opportunities across various protocols, helping you identify potential gems for maximizing your DeFi earnings.

- Visualization Powerhouse: Charts and graphs are your friends! DefiLlama empowers you to visualize historical and real-time data for any protocol or token. Track TVL fluctuations, analyze user growth, and identify potential trends with ease.

- Security First: Before diving in, assess the risk! DefiLlama provides access to audits and security information for different DeFi protocols, enabling you to make informed decisions based on their security posture.

- On-Chain Data Analysis: Go beyond the surface! DefiLlama grants you access to on-chain metrics like active users, transaction volume, and contract interactions, offering valuable insights into the inner workings of DeFi protocols.

Key Benefits and Value Proposition

DefiLlama goes beyond just presenting data; it empowers users with actionable insights. Here are some key benefits you can reap:

- Transparency and Accuracy: DefiLlama is committed to providing unbiased and up-to-date data, ensuring you make informed decisions based on reliable information.

- Comprehensive Scope: With its vast coverage of DeFi protocols and metrics, DefiLlama serves as a one-stop shop for in-depth analysis and comparison across the DeFi landscape.

- Accessibility for All: Whether you’re a DeFi newbie or a seasoned pro, DefiLlama’s user-friendly interface and intuitive design make it accessible to everyone.

- Time-Saving Efficiency: By centralizing valuable data and insights, DefiLlama saves you precious time and effort in your DeFi exploration, allowing you to focus on making strategic decisions.

Potential Drawbacks to Consider

While DefiLlama offers immense value, it’s crucial to be aware of potential drawbacks:

- Information Overload: The sheer volume of data can be overwhelming, especially for newcomers. Start slow, focus on specific areas of interest, and gradually expand your analysis as you gain comfort.

- Security Concerns: Remember, the DeFi space is inherently risky. Conduct thorough research and due diligence before interacting with any protocols, regardless of the data presented on DefiLlama.

Is DefiLlama Right for You?

If you’re looking to:

- Gain a comprehensive understanding of the DeFi landscape

- Identify high-yielding opportunities

- Conduct in-depth research on specific DeFi protocols

- Stay informed about industry trends and developments

Then DefiLlama is undoubtedly a valuable tool to add to your DeFi arsenal. However, if you’re entirely new to DeFi, it’s recommended to start with smaller, less complex platforms and gradually build your knowledge before diving deep into DefiLlama’s extensive data sets.

DefiLlama: Unlocking a Spectrum of Use Cases in DeFi

DefiLlama’s value extends far beyond mere data presentation. Its robust features translate into actionable insights, empowering users across various levels of DeFi expertise. Let’s explore some compelling use cases that showcase DefiLlama’s true potential:

For the DeFi Newbie

- Gaining a Foothold: Feeling overwhelmed by the DeFi landscape? DefiLlama’s protocol rankings offer a starting point, highlighting popular and active protocols categorized by blockchain and niche. Explore top Lending protocols, DEXes, or Yield Aggregators to understand the core DeFi functionalities.

- Yield Farming with Confidence: Seeking lucrative returns but unsure where to start? DefiLlama’s yield farming opportunities guide you towards high-yielding options across various protocols. Filter by risk tolerance and APY (Annual Percentage Yield) to identify potential gems without getting lost in the noise.

For the DeFi Enthusiast

- Deep Dives and Comparisons: Dive deeper with on-chain data analysis. Analyze active users, transaction volume, and contract interactions to assess a protocol’s health and user engagement. Compare protocols side-by-side using charts and graphs to make informed decisions about where to allocate your funds.

- Staying Ahead of the Curve: Utilize DefiLlama’s real-time TVL tracking to identify emerging trends and promising sectors within the DeFi ecosystem. Track sudden TVL surges in specific niches to uncover potential opportunities before they gain mainstream traction.

For the DeFi Power User

- Protocol Research and Due Diligence: Conducting in-depth research on a specific protocol? DefiLlama offers security information and audit reports, allowing you to evaluate a protocol’s security posture before interacting with it. This is crucial for mitigating risks in the inherently volatile DeFi space.

- Building DeFi Strategies: Leverage DefiLlama’s data to back your DeFi strategies. Analyze historical performance, project future trends, and identify potential correlations between different protocols to build diversified and data-driven investment strategies.

Additional Use Cases

- Tracking Portfolio Performance: Monitor the TVL and performance of DeFi protocols you’re invested in, gaining valuable insights into your portfolio’s overall health and identifying potential adjustments.

- Staying Informed: DefiLlama serves as a news aggregator for DeFi developments, keeping you updated on industry trends, protocol upgrades, and potential security risks.

Certainly! Here’s a comparison of DefiLlama with some of its key competitors in the DeFi data and analytics space:

| Competitor | Strengths | Weaknesses | Comparison to DefiLlama |

| CoinGecko | – Vast data coverage across crypto assets and exchanges – User-friendly interface – Excellent charting and visualization tools | – Less DeFi -specific features – Smaller focus on on-chain data analysis | More DeFi-focused, deeper on-chain data, but lacks CoinGecko’s broader crypto data coverage. |

| DappRadar | – In-depth analysis of DeFi protocols and dApps – TVL tracking and ranking – Active user metrics | – Can be complex for beginners – Focus primarily on dApps, not all DeFi sectors | Similar level of DeFi analysis, but DefiLlama covers a wider range of DeFi categories. |

| Messari | – High-quality research reports and insights – Focus on institutional investors – Pro version with advanced features | – Limited free features – Less user-friendly interface | More research-oriented, less accessible for beginners, compared to DefiLlama’s focus on user-friendly data exploration. |

| Dune Analytics | – Powerful custom queries and visualizations – Open-source platform with community-driven data exploration | – Requires coding knowledge – Less intuitive interface | Caters to data-savvy users, while DefiLlama is more user-friendly for beginners. drive_spreadsheetExport to Sheets |

Overall:

- DefiLlama stands out for its:

- User-friendly interface and intuitive design.

- Commitment to transparency and unbiased data.

- Wide range of features covering various DeFi sectors.

- For beginners: DefiLlama and CoinGecko are good starting points.

- For in-depth research: Messari or Dune Analytics can offer deeper insights.

- For specific needs: Choose the platform that best aligns with your desired level of complexity and data focus.

Remember, this is a general comparison. The best platform for you depends on your individual needs and preferences.

DefiLlama: Collaborating for a Thriving DeFi Ecosystem

While DefiLlama shines as a data powerhouse, its impact extends beyond its platform. Through strategic partnerships, it contributes to building a stronger and more vibrant DeFi ecosystem. Here’s a closer look at some notable collaborations:

Partnerships with Investors

- Digital Currency Group (DCG): A leading investor in the blockchain space, DCG collaborated with DefiLlama to analyze data and identify promising DeFi projects for investment. This partnership helps accelerate innovation and adoption within the DeFi industry.

- Collaborative Fund: Through collaborative research efforts, DefiLlama helped this venture capital firm uncover valuable insights into the DeFi landscape, ultimately fueling informed investment decisions and boosting promising projects.

Partnerships with Protocols

- LlamaoGrants: DefiLlama joined forces with LobsterDAO to create LlamaoGrants, a public good initiative providing information on ecosystem grants and incentive programs across the crypto space. This collaboration fosters transparency and promotes healthy competition within the DeFi ecosystem.

- Across Protocol: By analyzing Across Protocol’s data, DefiLlama helped assess the effectiveness of their strategic partnership rewards program, providing valuable insights for future optimization and growth.

Partnerships with Media and Data Providers

- Token Daily: This collaboration involved integrating DefiLlama’s data into Token Daily’s news platform, offering readers comprehensive on-chain data alongside news articles, enhancing reader understanding of the DeFi market.

- Figure: DefiLlama’s data found its way into Figure’s financial services platform, empowering Figure users with real-time insights into the DeFi landscape while making investment decisions.

Potential Benefits of Partnerships

- Data-Driven Decision Making: Collaborations with investors and protocols leverage DefiLlama’s data expertise, leading to more informed investment decisions and effective protocol development.

- Transparency and Education: Partnerships with media and data providers enhance accessibility and understanding of the DeFi landscape for a wider audience.

- Ecosystem Growth and Innovation: By fostering collaboration and knowledge sharing, these partnerships contribute to a more robust and innovative DeFi ecosystem overall.

Looking Ahead:

DefiLlama’s commitment to collaboration paves the way for a brighter future for DeFi. As the platform continues to expand its partnerships, we can expect even greater impact on the industry, fostering transparency, driving innovation, and ultimately empowering everyone involved in the exciting world of decentralized finance.

Conclusion: Navigate DeFi with Confidence

DefiLlama stands out as a powerful and versatile platform that empowers users to navigate the exciting yet challenging world of DeFi. With its commitment to transparency, accuracy, and comprehensive data, it serves as a valuable resource for both beginners and experienced DeFi participants. Remember, knowledge is power, and DefiLlama can be your guiding light in this ever-evolving financial frontier. However, never forget the importance of conducting your own research, exercising caution, and seeking professional advice before making any investment decisions.