Table of Contents

- The Genesis of DeFi: A Paradigm Shift in Financial Services

- Key Drivers of DeFi Innovation: Blockchain, Smart Contracts, and Cryptocurrencies

- Advantages of DeFi: Revolutionizing the Financial Landscape

- A Spectrum of DeFi Applications: Unveiling the Financial Landscape of the Future

- The Promise of DeFi: A More Equitable and Inclusive Financial Landscape

- Navigating the DeFi Landscape: A Framework for Informed Decision-Making

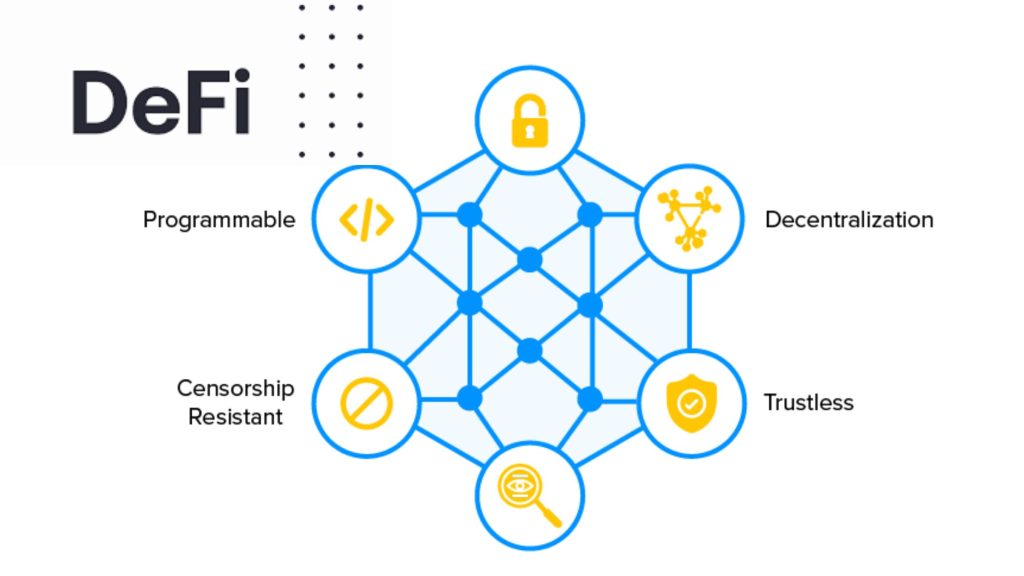

Decentralized finance (DeFi) has emerged as a transformative force in the financial world, challenging the traditional centralized financial system and offering a more democratized, transparent, and accessible approach to financial services. Built on the foundation of blockchain technology, DeFi applications enable peer-to-peer (P2P) transactions without the need for intermediaries like banks or brokerages. This decentralized structure empowers individuals to take control of their finances, fostering financial inclusion and reducing reliance on gatekeepers.

The Genesis of DeFi: A Paradigm Shift in Financial Services

The concept of DeFi has been gaining traction since the inception of cryptocurrency, with the introduction of decentralized exchanges (DEXs) in 2014. DEXs revolutionized the way cryptocurrencies are traded by facilitating direct transactions between users without intermediaries, marking a significant departure from traditional centralized exchanges. The development of smart contracts, self-executing contracts stored on blockchains, further fueled DeFi innovation. Smart contracts automate financial processes, eliminating the need for manual intervention and reducing transaction costs.

Key Drivers of DeFi Innovation: Blockchain, Smart Contracts, and Cryptocurrencies

DeFi’s transformative power stems from a few key components that enable its decentralized functionality:

-

Blockchain Technology: DeFi applications are anchored on blockchains, decentralized ledgers that record transactions in a secure and transparent manner. Blockchains provide immutability, ensuring that data cannot be tampered with once it is entered onto the network.

-

Smart Contracts: Smart contracts are self-executing contracts written in code that automate financial transactions on the blockchain. They streamline processes, reduce costs, and eliminate the need for intermediaries.

-

Cryptocurrencies: DeFi applications typically leverage cryptocurrencies, digital assets powered by blockchain technology. Cryptocurrencies enable secure and borderless transactions, facilitating seamless participation in DeFi protocols.

Advantages of DeFi: Revolutionizing the Financial Landscape

DeFi offers several compelling advantages over traditional financial systems:

-

Decentralization: DeFi eliminates intermediaries, reducing reliance on centralized institutions and empowering individuals to take control of their finances.

-

Accessibility: DeFi is accessible to anyone with an internet connection, regardless of geographical location or financial status.

-

Transparency: All transactions on a blockchain are publicly viewable, promoting transparency and accountability.

-

Cost-efficiency: DeFi eliminates the fees associated with traditional financial services, making financial services more affordable.

-

Innovation: DeFi is an open and permissionless ecosystem, fostering innovation and experimentation in financial products and services.

A Spectrum of DeFi Applications: Unveiling the Financial Landscape of the Future

DeFi applications encompass a diverse range of financial services, catering to a wide spectrum of user needs and interests, here are some of the most popular DeFi applications and their key functionalities:

1. Decentralized Exchanges (DEXs)

DEXs are blockchain-based platforms that allow users to trade cryptocurrencies directly with each other without the need for intermediaries like centralized exchanges. This eliminates the need for trust in third parties and provides greater control over funds.

Key functionalities:

- Peer-to-peer trading: Users can trade directly with each other, eliminating the need for intermediaries.

- Automated market makers (AMMs): AMMs provide liquidity for DEXs, ensuring efficient and transparent trading.

- No KYC/AML: DEXs often do not require Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures, making them more accessible to users.

2. Lending and Borrowing Platforms

Lending and borrowing platforms enable users to lend their cryptocurrencies to borrowers and earn interest on their deposits, or borrow cryptocurrencies to finance their activities. These platforms often offer higher interest rates than traditional banks.

Key functionalities:

- Loans: Users can borrow cryptocurrencies against collateral.

- Earning interest: Users can lend their cryptocurrencies and earn interest.

- Liquidity pools: Platforms often pool user funds into liquidity pools to provide loans.

3. Staking Platforms

Staking platforms allow users to stake their cryptocurrencies to support the network and earn rewards in the form of additional tokens. Staking is essential for securing Proof-of-Stake (PoS) blockchains.

Key functionalities:

- Staking rewards: Users earn rewards for staking their cryptocurrencies.

- Network security: Staking helps to secure the network.

- Governance participation: Staking often grants users voting rights on protocol decisions.

4. Derivatives Trading Platforms

Decentralized derivatives platforms allow users to trade a variety of derivative products, such as options and futures. These products allow users to hedge their positions, speculate on market movements, and manage risk more effectively.

Key functionalities:

- Trading of derivative products: Users can trade options, futures, and other derivative products.

- Transparent pricing: Pricing is based on transparent market mechanisms.

- No counterparty risk: Users trade directly with each other, eliminating counterparty risk.

5. Insurance Platforms

Decentralized insurance platforms offer insurance products to protect users from losses due to DeFi risks, such as smart contract vulnerabilities and market volatility.

Key functionalities:

- Insurance against smart contract failures: Protects users from losses due to smart contract bugs.

- Insurance against impermanent loss: Protects liquidity providers from losses due to price fluctuations.

- Risk mitigation: Help to mitigate risks associated with DeFi activities.

6. Yield Farming Platforms

Yield farming platforms allow users to earn high yields by depositing their cryptocurrencies into various DeFi protocols. This involves strategically moving funds between different protocols to maximize returns.

Key functionalities:

- Combining yield opportunities: Users can combine yield-bearing opportunities from multiple protocols.

- Optimizing yields: Automated algorithms optimize yields based on market conditions.

- Risk management: Diversification helps to mitigate risks.

These are just a few examples of the many DeFi applications available. The DeFi landscape is constantly evolving, and new applications are emerging all the time. As DeFi matures, it is expected to have an even greater impact on the financial industry.

The Promise of DeFi: A More Equitable and Inclusive Financial Landscape

DeFi holds immense potential to reshape the financial landscape, offering several transformative benefits:

Greater Financial Inclusion: DeFi eliminates geographical and socioeconomic barriers, empowering individuals in underserved regions to access financial services.

Reduced Costs: DeFi eliminates unnecessary intermediaries and their associated fees, making financial services more affordable and accessible.

Enhanced Transparency: DeFi transactions are publicly viewable, fostering trust and accountability.

Increased Efficiency: DeFi protocols are often automated, reducing transaction costs and processing times.

Enhanced Control: DeFi users retain control over their funds and have greater decision-making power over their finances.

Navigating the Challenges: Ensuring the Sustainability of DeFi

Despite its transformative potential, DeFi faces several challenges that require careful consideration and proactive mitigation strategies:

Regulation: DeFi operates in a largely unregulated environment, raising concerns about consumer protection and market manipulation. As DeFi grows in prominence, regulatory frameworks need to adapt to address these concerns effectively.

Cybersecurity: DeFi protocols are vulnerable to cyberattacks, and smart contracts can contain bugs that lead to unintended consequences. Robust cybersecurity measures and thorough smart contract audits are essential to safeguard user funds and prevent potential losses.

User Experience: DeFi applications can be complex and difficult to navigate, hindering user adoption and hindering the growth of the ecosystem. Simplicity, user-friendliness, and accessibility are crucial for attracting a wider user base and ensuring the long-term sustainability of DeFi.

Liquidity: Certain DeFi protocols may lack sufficient liquidity, making it difficult to execute trades or withdraw funds. Mechanisms to enhance liquidity and improve the efficiency of the DeFi market.

Navigating the DeFi Landscape: A Framework for Informed Decision-Making

While DeFi presents a promising future, it is crucial to approach it with caution and due diligence. Users should carefully consider the following factors before engaging with DeFi protocols:

Technical Expertise: DeFi requires a certain level of technical understanding to navigate its complexities. Users should invest in learning about the underlying technology and protocols.

Risk Assessment: DeFi is still a nascent and evolving field, and there are inherent risks associated with smart contract vulnerabilities, market volatility, and regulatory uncertainty. Users should carefully assess their risk tolerance and financial needs before investing.

Diversification: As with any investment strategy, diversification is key. Avoid overinvesting in a single DeFi protocol or asset class. Spreading investments across multiple protocols and assets can help mitigate risks.

Continuous Learning: The DeFi landscape is constantly evolving, and new developments emerge regularly. Users should stay informed about the latest trends, research new protocols, and adapt their strategies accordingly.

Conclusion

DeFi represents a paradigm shift in finance, offering a more equitable, inclusive, and efficient financial system. However, it is important to approach DeFi with caution and due diligence, carefully assessing risks, diversifying investments, and staying abreast of the latest developments. By doing so, individuals can harness the power of DeFi to enhance their financial well-being and participate in a more democratized financial landscape.

here are some of the top sources for information about DeFi:

- DeFi Pulse: DeFi Pulse is a comprehensive resource for DeFi data, including total value locked (TVL), active users, and the top DeFi protocols. https://defipulse.com/

- DeFi Llama: DeFi Llama is another popular DeFi data resource, with a focus on liquidity pools and decentralized exchange (DEX) metrics. https://defillama.com/

- CoinMarketCap: CoinMarketCap is a general cryptocurrency market data platform that also provides DeFi-specific metrics, such as TVL and number of active wallets. https://coinmarketcap.com/currencies/defi/

- The Defiant: The Defiant is a news and analysis platform focused on DeFi, with articles, interviews, and market insights. https://thedefiant.io/

- Defi Pulse Weekly: Defi Pulse Weekly is a weekly newsletter from DeFi Pulse with summaries of the latest DeFi news, events, and developments. https://www.defipulse.com/blog

- DeFi Edge: DeFi Edge is a research platform that provides in-depth analysis of DeFi protocols and trends. https://thedefiedge.com/

- The Block: The Block is a financial media outlet with a dedicated DeFi section covering news, analysis, and commentary. https://9now.nine.com.au/the-block

In addition to these general resources, some many websites and blogs focus on specific aspects of DeFi, such as lending and borrowing, yield farming, and decentralized exchanges. It is important to do your research and understand the risks associated with any DeFi project before you invest.