The cryptocurrency market, like any other financial market, operates with its own distinct dynamics and demands careful navigation. While technical analysis and future predictions rely on valuable experience, data, and historical trends, the crypto market’s unique ecosystem – encompassing diverse applications, market size, and influential players – requires a nuanced approach.

This weekly update aims to empower you with concise insights into the market landscape, enabling you to make informed decisions, strategize your financial week effectively, and navigate your investments with greater confidence. Remember, your invaluable feedback helps us refine this content and ultimately contribute to your success.

However, it’s crucial to emphasize that this information serves solely as educational material and does not constitute financial advice. Your investment decisions, along with any associated profits or losses, remain solely your responsibility.

Understanding the crucial role of technical analysis in crypto empowers you to make informed investment decisions:

- Technical analysis equips you with tools to identify past price patterns and potential future trends. By analyzing charts, indicators, and support/resistance levels, you gain valuable insights into potential market movements.

- While not foolproof, technical analysis empowers you to make data-driven decisions and potentially mitigate risks. It helps you recognize entry and exit points aligned with your investment goals.

- Technical analysis complements fundamental analysis for a comprehensive understanding. Combining both approaches offers a well-rounded perspective on the market and specific cryptocurrencies.

Remember, no single approach guarantees success. Always:

- Conduct thorough research before investing in any cryptocurrency. Understand the project, its technology, and its potential impact.

- Diversify your portfolio to mitigate risk. Don’t put all your eggs in one basket.

- Invest only what you can afford to lose. Cryptocurrencies are inherently volatile, and prices can fluctuate significantly.

- Never make investment decisions based solely on speculation or hype. Do your own due diligence and trust your research.

By combining essential technical analysis skills with informed decision-making and responsible investing practices, you can navigate the crypto market with greater confidence and potentially achieve your financial goals.

Remember, the journey to successful investment in crypto requires continuous learning and responsible decision-making. We’re here to support you with informative content and encourage you to stay informed on market developments.

Markets in the last week

Bitcoin has crossed the $71,000 mark significantly, reaching its highest level yet and surpassing silver in market capitalization. This surge not only cements its position as a top global asset but also sparks a wave of predictions for its future prospects. Bitcoin’s growing acceptance could pave the way for other cryptocurrencies, with Ethereum being the most prominent.

Meanwhile, Cathie Wood, the visionary CEO of ARK Invest, has made a bold prediction about Bitcoin’s future price trajectory, forecasting the digital giant to reach over $1 million by 2030, a figure that was once considered unimaginable.

BlackRock’s iShares Bitcoin ETF (IBIT) has managed to accumulate 195,985 Bitcoins in less than two months since its launch, surpassing Michael Saylor’s MicroStrategy holdings of 193,000 tokens as of February 26. This development indicates the growing institutional interest in Bitcoin and the potential for asset-backed ETFs to become major players in the cryptocurrency market.

Bitcoin

Major macro events are coming up, liquidity in Bitcoin is expected to exceed the price ceiling and then face a price drop. Meanwhile: Altcoins are taking off!

Altcoins

40-60% of the market value is still left for altcoins. It will be an exciting ride for altcoins in the period ahead.

Ethereum

The next cryptocurrency to reach a new all-time high is likely to be Ethereum, due to the Duncan update and the possibility of ETF approval. A key resistance level is approaching, but Bitcoin’s price has remained relatively unchanged. We will likely see more strength from this asset.

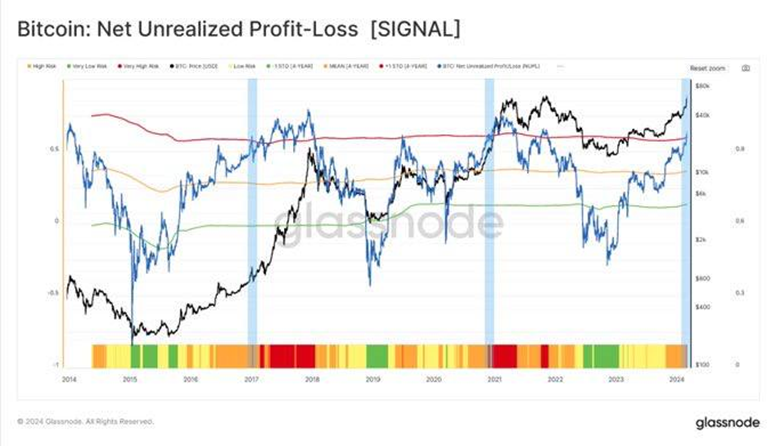

The Next move?

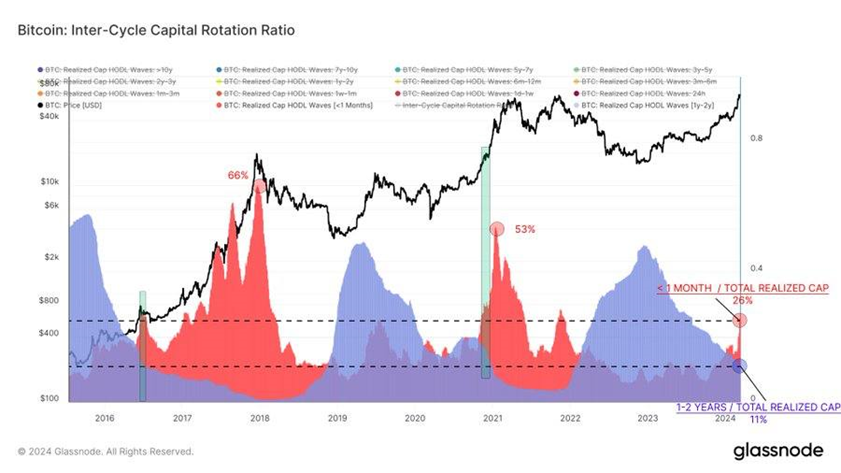

Market Participants in the Past Month (🟥): New investors who have recently entered the market.

1-2 Year Participants (🟦): More experienced investors who have been in the market for 1 to 2 years.

In the Top Formation Phase in Previous Cycles:

- The share of sub-1 month participants increases to over 50%.

- The share of 1-2 year participants decreases to less than 5%.

Currently:

- The share of sub-1 month participants is around 26%.

- The share of 1-2 year participants is around 11%.

Comparison with Previous Cycles:

- The current share of both groups of participants is far from the peak numbers of the previous two cycles.

Conclusion:

- Despite the uncertainty, the wealth distribution chart shows that we are still far from reaching the market top.

- Going forward, as demand from inexperienced investors increases, we will see an increase in FOMO and likely price increases.

- On the other hand, as we approach the top, the willingness of long-term investors to sell Bitcoin with an average purchase price of $20-25,000 will increase.

Additional Information:

- The chart shows the distribution of Bitcoin wealth by the time period in which investors bought their Bitcoin.

- The red area represents investors who have bought Bitcoin in the past month.

- The blue area represents investors who have bought Bitcoin between 1 and 2 years ago.

- The gray area represents investors who have bought Bitcoin more than 2 years ago.

- The chart shows that the share of sub-1 month participants is currently much lower than it was at the peak of the previous two cycles.

- This suggests that we are still early in the current bull market cycle.

- However, it is important to note that the chart does not take into account the size of each investor’s Bitcoin holdings.

- It is possible that a small number of large investors with long-term holdings could have a significant impact on the market.

Overall, the chart suggests that we are still in the early stages of the current bull market cycle. However, it is important to remember that the market is unpredictable and that there is no guarantee that the trend will continue.

Crypto News Package for the Week of March 3th – 10th, 2024:

China: There are ongoing concerns about negative inflation in China, as their manufacturing activity has contracted for the fifth consecutive month. This could have a ripple effect on global trade.

United States:

- Consumer Confidence: Recent surveys show that consumers are optimistic about the economic outlook. This could be a positive sign for consumer spending.

- Job Market: There are no major jobs reports this week, but it is worth paying attention to news about upcoming data releases.

Other Parts of the World:

- Japan: The Bank of Japan is considering declaring an end to negative inflation, which could impact their monetary policy decisions.

- Australia: Economic data from Australia, including building permits and employment ads, was mixed last week.

Events to Watch:

- Pay attention to statements from central banks, particularly the Bank of Japan.

- Watch for upcoming US jobs data, which could be an important indicator of economic health.

Bitcoin Surge: Bitcoin continues to surge, reaching over $65,000 and approaching its all-time high.

Meme Coin Rally: Meme coins like SHIB and WIF saw significant gains this week, while Dogecoin and Shiba Inu were relatively quiet.

BlackRock Bitcoin ETF: BlackRock’s Bitcoin ETF has begun trading in Brazil, which could be a potential step towards wider institutional adoption of cryptocurrency.

Regulatory Update: A US judge ruled that the secondary market sale of certain crypto assets could be considered securities transactions, which could have implications for regulation.

Ethereum Upgrade: Ethereum developers are targeting March 13th for the “Duncan” upgrade on the mainnet.

Solana Gaming Project: Solana-based gaming project MixMob has acquired the rights to create non-fungible tokens (NFTs) based on Star Wars Stormtrooper characters.

Experiment: The emergence of Trump-themed MAGA coins is seen as a first experiment in “PoliFi” or the intersection of politics and decentralized finance (DeFi).

Events:

- Binance Live Q&A: Join Thejencoin on Binance Live Q&A on March 4th, 1 PM UTC.

Disclaimer:

This information is for general informational purposes only and does not constitute investment advice. Please do your own research before making any investment decisions.

Dude, your advice and the stuff you said are awesome. Keep it up, you’re doing great!

Overall, it’s a good analysis, although I don’t think it’s bad to have fundamental analysis, especially in cryptocurrencies, it might even be better to increase the news section.

You got a point, bro. Like I said, the crypto market is a wild beast and you can’t tame it with just one type of analysis, like technical analysis. But each type of analysis can give you a better understanding of what’s going on. I’m sharing all this info not just to teach you stuff, but also because maybe one of you is about to make a decision about crypto, and with this knowledge, you can make a better choice.

I checked out the analysis and I’m on board with most of it. I’m not sure if I should stay out of it for now or start dipping my toes in the water. I’m gonna wait and see what happens next week.

Thanks, buddy! I hope you check back in on this thread next week. The key thing right now is to pick the right strategy. DCA might be the safer and more reliable approach.

Ironic! You thought the market would be down this week, but it’s actually going up! :)))))

Hey buddy, thanks for your opinion! 🙂 Just keep a few things in mind:

First, as I said at the beginning, the crypto market is unpredictable by nature and can’t be predicted solely by technical analysis. What I’ve provided here is technical analysis, not a fortune-telling!

Second, as you can see, the timeframe for this analysis is weekly. So, we need to consider the weekly outcome.

Finally, I still believe the market will correct itself, maybe not today or tomorrow, but I still stand by my analysis and won’t change it unless I see a significant change in trend (though I will change it if necessary and let you know!).

I hope you’ll continue to follow us and check in next week!