The highly anticipated Bitcoin halving of 2024 occurred on April 19th, marking a significant event in the cryptocurrency’s history. Let’s delve deeper into what this means:

What is a Bitcoin Halving?

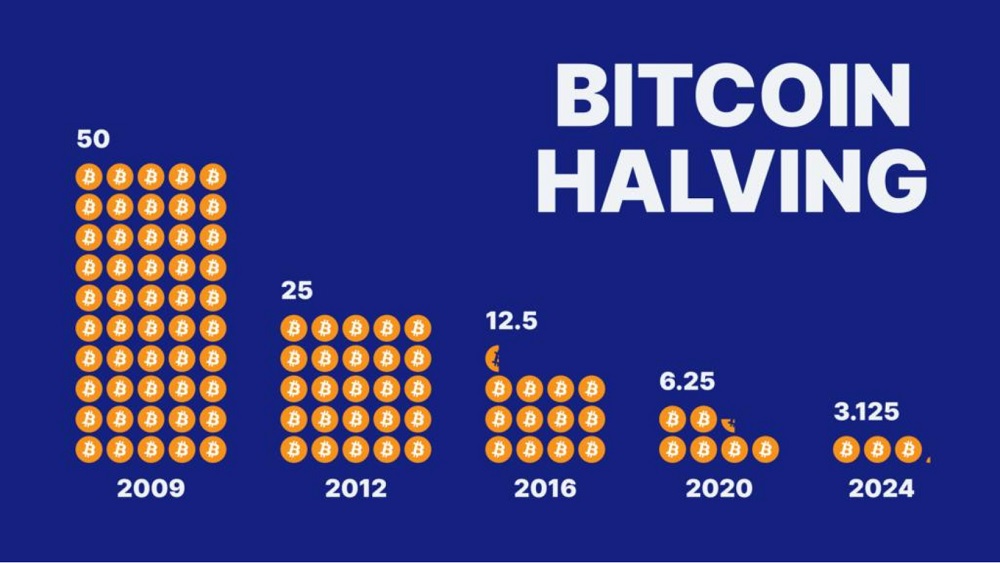

Bitcoin’s protocol is programmed to automatically cut the block reward for miners in half roughly every four years, or after every 210,000 blocks are mined. This event reduces the rate at which new Bitcoins enter circulation.

Why Does Halving Matter?

- Scarcity: Halving essentially creates scarcity for Bitcoin. With fewer new coins being created, existing Bitcoins become relatively more scarce, potentially driving up the price if demand stays the same or increases.

- Miner Incentives: The reward reduction incentivizes miners to continue securing the network through transaction fees. As the block reward gets smaller, transaction fees become a more significant portion of their income.

What Happened During the 2024 Halving?

- The block reward for miners dropped from 6.25 BTC to 3.125 BTC.

- The price of Bitcoin remained relatively stable around $63,000 in the immediate aftermath, surprising some who predicted a surge.

- This is the fourth halving in Bitcoin’s history, with previous halvings being followed by price increases, but past performance is not a guarantee of future results.

Reviewing the Event

The 2024 halving played out as expected in terms of the block reward reduction. However, the lack of a significant price increase right after the event has some analysts re-evaluating their short-term predictions.

Here are some ongoing discussions:

- Long-Term Price Impact: While the price didn’t spike immediately, some analysts believe scarcity will play out in the long run, potentially driving prices higher.

- Market Factors: Other factors like global economic conditions and adoption rates may also influence Bitcoin’s price more than the halving itself.

Predicting the cryptocurrency market for the next few weeks is notoriously difficult. However, given the recent Bitcoin halving on April 19th, 2024, here’s a breakdown of some factors that could influence the market:

Potential for Bitcoin Price Increase:

- Scarcity: Reduced supply of new Bitcoins due to the halving could lead to increased demand and a price rise in the long run. However, this might not be immediate.

- Investor Sentiment: Positive sentiment surrounding the halving could drive some investors to buy Bitcoin in anticipation of future price increases.

Counteracting Forces:

- Market Volatility: The halving itself might introduce short-term volatility as investors react and adjust their positions.

- External Factors: Global economic conditions, regulations, and unexpected events can all significantly impact the crypto market, independent of the halving.

Impact on Altcoins:

- Increased Investment in Altcoins: Some investors might shift focus to established altcoins with strong projects, potentially boosting their prices.

- Correlation with Bitcoin: Many altcoins tend to follow Bitcoin’s price movements. If Bitcoin experiences a significant price increase, it could pull some altcoins along.

- Focus on Fundamentals: The halving might push investors to prioritize altcoins with strong underlying projects, benefiting those with good use cases.

Remember, the cryptocurrency market is inherently volatile and complex. The 2024 Bitcoin halving is a significant event, but it’s just one factor among many that can influence prices. Here are some additional tips to keep in mind as you navigate the market in the coming weeks:

- Don’t chase trends: Avoid investing in any cryptocurrency based solely on hype or a sudden price surge. Instead, focus on projects with strong fundamentals and a long-term vision.

- Conduct thorough research: Before investing in any cryptocurrency, take the time to understand the project’s technology, team, and roadmap. Look for projects that are solving real-world problems and have a clear path to adoption.

- Diversify your portfolio: Don’t put all your eggs in one basket. Spread your investments across different cryptocurrencies with varying risk profiles to mitigate potential losses.

- Invest what you can afford to lose: The crypto market is full of opportunities, but it’s also important to be prepared for the possibility of losing your investment. Only invest what you can afford to lose without jeopardizing your financial stability.

- Stay informed and be patient: The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news and developments, but also be patient. Long-term success in crypto requires a combination of knowledge, strategy, and a bit of luck.