Table of Contents

- Recent Developments and Expansion

- Financial Performance and Market Position

- Financial Outlook and Future Prospects

- Financial Considerations for Investors

- Partnerships

- How to use Aave

- Conclusion

Aave, formerly known as ETHLend, has established itself as a leading decentralized finance (DeFi) lending protocol, disrupting the traditional financial system by providing open-source, non-custodial access to lending and borrowing services. With its innovative features, robust security measures, and growing ecosystem, Aave has attracted a vast user base and captured a significant share of the DeFi market.

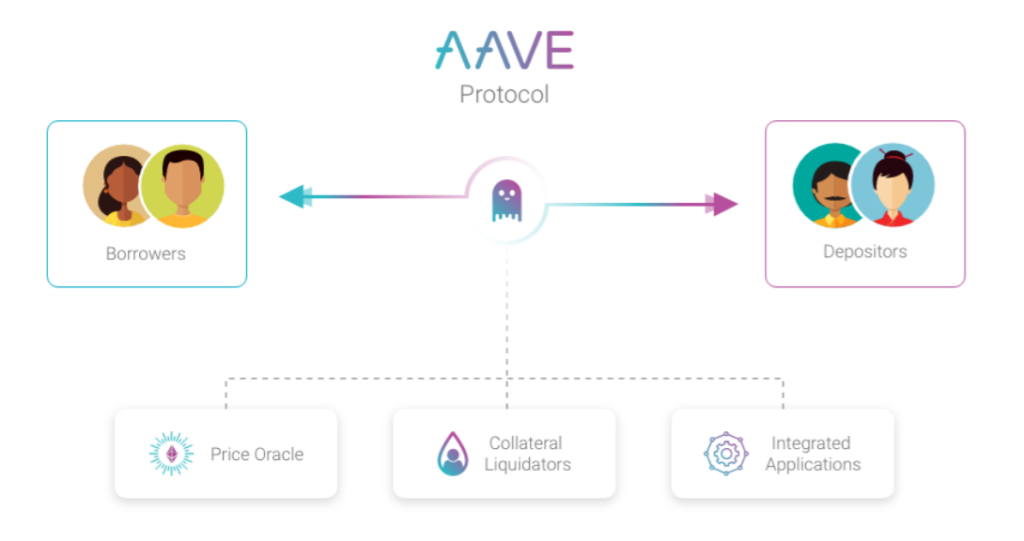

Aave operates on a set of smart contracts that automate the lending and borrowing process. These contracts are deployed on a decentralized blockchain, such as Ethereum, which means that they are not controlled by any single entity. This makes Aave censorship-resistant and tamper-proof.

Lending

To lend on Aave, users deposit their cryptocurrency into a liquidity pool. The protocol then uses this liquidity to provide loans to borrowers. In return, lenders earn interest on their deposited funds. The interest rate is determined by market demand and supply, and it can fluctuate over time.

Borrowing

To borrow on Aave, users must provide collateral in the form of cryptocurrency. The amount of collateral that is required depends on the asset being borrowed and the borrower’s creditworthiness. If the value of the collateral falls below a certain threshold, the borrower’s loan position may be liquidated.

Recent Developments and Expansion

Aave has demonstrated remarkable growth in recent years, expanding its reach across multiple blockchains, including Ethereum, Polygon, Avalanche, Fantom, and Arbitrum. This expansion has enabled the protocol to cater to a wider audience and mitigate the risk of being confined to a single blockchain.

In addition to cross-chain compatibility, Aave has introduced several key features that have enhanced its functionality and user experience. These include:

- Aave V3: The latest major iteration of the Aave protocol, introducing several improvements and enhancements to the protocol’s functionality. Here’s a brief overview of the key features of Aave V3:

- More Flexible Interest Rate Models: Aave V3 introduces a new interest rate model that allows for dynamic interest rates based on supply and demand for each asset. This flexibility enables the protocol to respond more efficiently to market conditions and provide borrowers and lenders with better rates.

- Enhanced Collateral Types: Aave V3 expands the range of supported collateral types, enabling users to borrow against a wider variety of assets, including stablecoins, wrapped tokens, and synthetic assets. This versatility expands the pool of potential borrowers and lenders.

- Improved Liquidation Mechanisms: Aave V3 enhances liquidation mechanisms to ensure that borrowers are swiftly and fairly liquidated when their collateral falls below the required threshold. These improvements aim to protect the protocol and its users from potential losses.

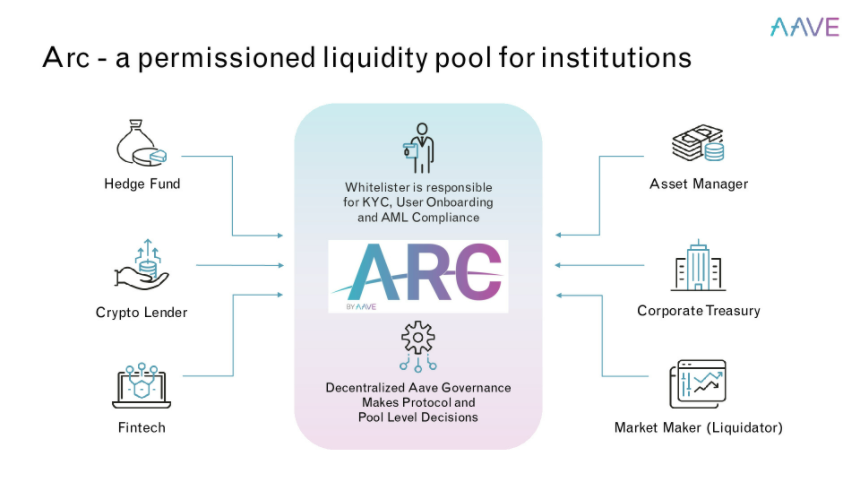

- Aave Arc: A dedicated platform for lending and borrowing assets pegged to fiat currencies, providing users with exposure to traditional financial markets without leaving the DeFi ecosystem. This platform offers several advantages, including:

- Access to Traditional Markets: Aave Arc enables users to participate in DeFi while accessing assets pegged to fiat currencies, such as USDT, USDC, and DAI. This provides a gateway to traditional financial markets and diversifies investment options.

- Stable Interest Rates: Aave Arc offers relatively stable interest rates, mitigating the market volatility that can affect cryptocurrency lending and borrowing. This stability makes it an attractive option for users seeking predictable returns.

- Reduced Counterparty Risk: By utilizing fiat-pegged assets, Aave Arc reduces counterparty risk, as users are not exposed to the fluctuations of cryptocurrency values. This enhances the security and reliability of the platform.

- Aave DeFi Insurance Fund: A collaborative initiative that pools funds from Aave users to cover potential liquidations and protect the protocol from losses. This fund serves as a safety net for the protocol and its users, ensuring that the system remains resilient in the event of market downturns or unforeseen events.

- Shared Risk Management: The Aave DeFi Insurance Fund spreads the risk of liquidations across a large pool of users, reducing the burden on any individual user. This shared risk management approach enhances the overall stability and security of the protocol.

- Enhanced Liquidity: By providing a safety net for liquidations, the Aave DeFi Insurance Fund incentivizes liquidity providers and borrowers to participate in the protocol. This increased liquidity contributes to the overall efficiency and robustness of the system.

Financial Performance and Market Position

Aave’s financial performance has been consistently strong. As of February 1, 2024, Aave’s total value locked (TVL) stands at approximately $8.155 billion, spread across multiple blockchains, including Ethereum, Polygon, Avalanche, Fantom, and Arbitrum. This growth reflects the increasing adoption of DeFi and the growing recognition of Aave’s capabilities.

In terms of market share, Aave consistently ranks among the top DeFi protocols, consistently maintaining a position within the top three. This dominant position indicates the protocol’s continued appeal to users and its ability to attract significant liquidity.

Financial Outlook and Future Prospects

Aave’s future prospects appear promising, with several factors contributing to its potential for continued growth:

- Expanding Ecosystem: The Aave ecosystem continues to expand, with new integrations and partnerships being announced regularly. This expansion will broaden the protocol’s reach and attract more users.

- Innovative Features: Aave’s commitment to innovation is evident in its ongoing development of new features, such as Aave Arc and Aave V3. These enhancements will further enhance the protocol’s functionality and appeal to a broader range of users.

- Regulatory Outlook: While regulatory uncertainty remains a concern for the DeFi industry, Aave has demonstrated a proactive approach to engaging with regulators and building a compliant infrastructure. This approach should help mitigate regulatory risks and ensure the long-term viability of the protocol.

Financial Considerations for Investors

Aave’s attractive features and strong performance make it an attractive investment opportunity for DeFi enthusiasts. However, it’s crucial to acknowledge the inherent risks associated with DeFi, including smart contract vulnerabilities, market volatility, and potential impermanent loss for liquidity providers.

Investors should conduct thorough research, understand the risks involved, and only invest funds that they can afford to lose. Aave’s strong track record, committed development team, and growing ecosystem suggest that it has the potential to deliver long-term value for investors.

Partnerships

Aave has partnered with numerous companies across various industries to enhance its functionality and reach a wider audience. These partnerships have contributed to Aave’s growth and adoption, and they continue to play a critical role in the protocol’s success.

Partnerships with Financial Institutions

Aave has collaborated with several financial institutions to integrate its lending and borrowing services into traditional financial systems. These partnerships aim to bridge the gap between centralized and decentralized finance, providing institutional investors with access to DeFi opportunities.

- Silvergate Bank: Aave partnered with Silvergate Bank to provide collateralized loans in USDC stablecoin, leveraging Silvergate’s banking infrastructure for traditional fiat on-ramps.

- Barclays: Aave collaborated with Barclays to develop a DeFi liquidity pool for institutional investors, enabling them to access DeFi markets through a trusted financial institution.

- CitiBank: Aave announced a partnership with CitiBank to explore potential collaborations in the DeFi space, including the integration of Aave’s lending and borrowing services into CitiBank’s platform.

Partnerships with DeFi Platforms

Aave has partnered with various DeFi platforms to expand its ecosystem and provide users with a seamless user experience. These partnerships aim to integrate Aave’s services into existing DeFi applications, making it easier for users to access Aave’s liquidity from a variety of platforms.

- Curve Finance: Aave partnered with Curve Finance to create pooled liquidity pools, enabling users to swap between a variety of stablecoins with minimal slippage.

- Balancer: Aave collaborated with Balancer to create stablecoin pools, providing users with access to diversified stablecoin exposure.

- Synthetix: Aave partnered with Synthetix to allow users to borrow and mint synthetic assets using Aave’s liquidity.

Partnerships with Blockchains and Ecosystems

Aave has partnered with multiple blockchains and ecosystems to expand its reach and integrate its services into broader DeFi landscapes. These partnerships aim to make Aave accessible to a wider audience and provide users with more options for interacting with the protocol.

- Ethereum: Aave is one of the most popular protocols on the Ethereum blockchain, and the two platforms have worked together closely to develop and promote decentralized finance. Ethereum provides Aave with a secure and scalable infrastructure, while Aave contributes to the growth of the DeFi ecosystem on Ethereum. The partnership between Aave and Ethereum has been mutually beneficial. Aave has benefited from Ethereum’s large user base and developer community, while Ethereum has benefited from Aave’s innovative features and growing popularity.

- Polygon: Aave partnered with Polygon to deploy its lending and borrowing protocol on the Polygon network, providing users with faster transactions and lower fees.

- Avalanche: Aave collaborated with Avalanche to launch its protocol on the Avalanche network, offering users access to DeFi services with enhanced scalability.

- Fantom: Aave partnered with Fantom to deploy its protocol on the Fantom network, providing users with a high-throughput and low-cost alternative to Ethereum-based DeFi.

- Arbitrum: Aave has launched a version of its protocol on the Arbitrum blockchain, which is another layer-2 scaling solution for Ethereum. This has helped Aave to reach a wider audience and reduce transaction fees.

Partnerships with Applications and Businesses

Aave has partnered with various applications and businesses to integrate its lending and borrowing services into their platforms, providing users with new ways to interact with DeFi. These partnerships aim to expand Aave’s reach and make its services more accessible to a broader audience.

- dYdX: Aave partnered with dYdX to create a combined lending and borrowing pool, enabling users to access both protocols’ liquidity with a single interface.

- MetaMask: Aave collaborated with MetaMask to integrate its protocol into the MetaMask wallet, providing users with a seamless way to interact with Aave from their mobile devices.

- Ledger: Aave announced a partnership with Ledger, a hardware wallet provider, to integrate its protocol into Ledger’s hardware wallets, enabling users to store and manage their Aave assets securely.

Aave’s extensive network of partnerships has played a crucial role in its growth and adoption. These partnerships have helped Aave expand its reach, enhance its functionality, and attract a wider audience. As Aave continues to innovate and expand its ecosystem, these partnerships will be essential in shaping its future and solidifying its position as a leading force in the decentralized finance space.

How to use Aave

This comprehensive guide will walk you through the step-by-step process of using Aave, from connecting your wallet to borrowing funds and providing liquidity. We’ll also delve into additional tips to ensure you make informed decisions and mitigate potential risks.

Prerequisites:

- A Supported Cryptocurrency Wallet: Aave supports various wallets, including MetaMask, WalletConnect, and WalletLink.

- Sufficient Cryptocurrency Funds: You’ll need to deposit crypto assets into your wallet to utilize Aave’s lending and borrowing services.

- Understanding of Smart Contracts and DeFi Risks: Aave is a decentralized protocol, so you should be familiar with smart contracts and the risks associated with DeFi.

Step 1: Connect Your Wallet to Aave

- Visit the Aave website (aave.com) and click on the “Connect Wallet” button in the top right corner.

- Select your preferred wallet from the list of supported wallets.

- Follow the instructions provided by the Aave website to establish the connection.

Step 2: Deposit Funds into Your Aave Wallet

- Once your wallet is connected, you’ll be able to view your available balance and the supported assets.

- Select the asset you want to deposit and enter the amount you wish to deposit.

- Click on the “Deposit” button to confirm the transaction.

Step 3: Borrow Funds Using Your Deposited Assets as Collateral

- Select the asset you want to borrow and enter the amount you want to borrow.

- The Aave protocol will automatically calculate the minimum collateral required based on the selected asset and the current market conditions.

- Ensure you have sufficient collateral in your wallet to cover the potential liquidation threshold.

- Click on the “Borrow” button to confirm the transaction.

Step 4: Earn Interest by Providing Liquidity to Aave Liquidity Pools

- Select the asset you want to provide liquidity for and enter the amount you want to add to the liquidity pool.

- Aave will allocate your funds to a pool with a matching collateral asset.

- You will receive a portion of the fees generated by the pool’s transactions.

- Note that providing liquidity also exposes you to impermanent loss.

Step 5: Repay Your Borrowed Funds and Withdraw Your Collateral

- Once you’ve borrowed funds, you can repay them by selecting the asset you borrowed and entering the amount you want to repay.

- Aave will calculate the outstanding balance and interest accrued.

- Click on the “Repay” button to confirm the transaction.

- Once the repayment is complete, your collateral will be automatically unlocked, and you can withdraw it back to your wallet.

Additional Tips:

- Familiarize Yourself with Aave’s Documentation: Thoroughly understand the protocol’s features, risks, and user interface to make informed decisions.

- Monitor Market Conditions and Interest Rates: Stay updated on market fluctuations and adjust your strategies accordingly.

- Secure Your Funds with a Hardware Wallet: Utilize a hardware wallet for offline storage and enhanced security of your cryptocurrency assets.

- Practice Caution and Minimize Risks: Only invest funds that you can afford to lose and exercise caution when interacting with the platform.

Conclusion

Aave has emerged as a leading force in the decentralized lending space, offering a comprehensive suite of features and a deep pool of liquidity. Its innovative approach, robust security, and expanding ecosystem make it a compelling choice for both individual and institutional investors seeking to participate in the DeFi revolution. As the DeFi landscape continues to evolve, Aave is well-positioned to remain a frontrunner, shaping the future of decentralized finance.

here are some resources for Aave with their links:

Official Aave website: https://aave.com/

This is the official website for Aave, where you can find information about the protocol, its features, and how to use it.

Aave blog: https://medium.com/aave

This blog is a great source of news and updates about Aave. You can also find articles about AAVE token economics, governance, and security.

Aave docs: https://docs.aave.com/

The Aave docs are a comprehensive resource for learning about Aave’s technical specifications, including its smart contracts, protocol parameters, and APIs.

Aave GitHub: https://github.com/aave

The Aave GitHub repository is where you can find the source code for the Aave protocol. You can also submit bug reports and contribute to the development of the protocol.

Aave Discord: https://discord.com/invite/aave

The Aave Discord is a great place to connect with other Aave users and developers. You can ask questions, get help, and participate in discussions about the protocol.

Aave Twitter: https://aave.com/

Aave’s Twitter account is a great way to stay up-to-date on the latest news and developments. You can also follow Aave’s team and other community members.